IS YOUR INVESTMENT ADVISOR A FIDUCIARY?

Have you already invested all of your hard-earned money in a safe place? If not, this article will guide you in the right direction. However, if you have already invested, this article might make you question the security of your money… as not all financial planners and investment managers are fiduciaries.

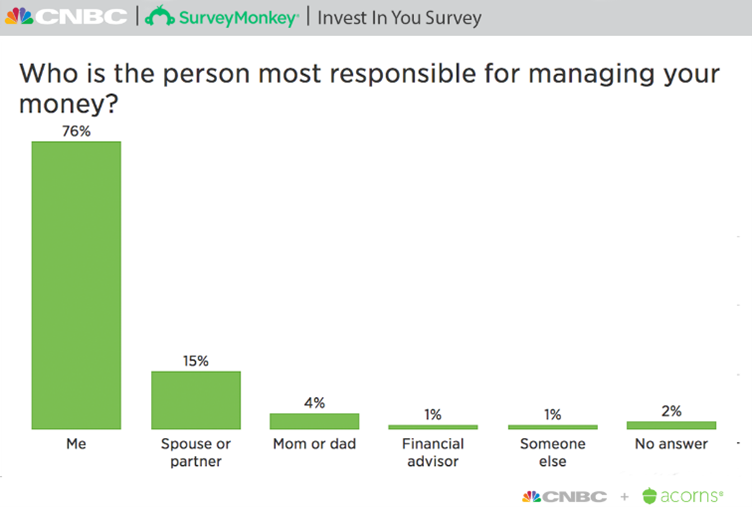

According to a CNBC report, about 99% of Americans don’t hire a financial advisor at all, let alone a fiduciary. And most said their money is managed by themselves or by their better half. No wonder why half of the people around us say, “financially, we only make ends meet!”

The internet is flooded with financial information and money gurus teaching ways to invest your money. But unfortunately, this can lead to anxiousness rather than blessing us with the confidence to invest. So… the question we should ask ourselves is, ‘Why aren’t we taking professional help?!?” There are a plethora of investment managers, financial planners, money advisors, bankers, and brokers in this professional space, but choosing what fits you and your future requirements is a cumbersome task.

While selecting yourself a financial advisor, you must not overlook the advisor’s responsibility towards you. All of these professionals might not keep your needs as a priority and may not recommend the best possible investment plan. In a non-fiduciary relationship, the advisor’s recommendations do not need to be in your best interest, but only ‘suitable’. According to the 2015 President’s Council of Economic Advisers report, due to non-fiduciary advisors, each year investors lose 1% on their investments, amounting to a total of $17 billion annually!

Now you may wonder, WHAT IS A FIDUCIARY?

A fiduciary is a person or organization that manages the money and assets of another person in compliance to the fiduciary standards. These standards are legal and ethical, which binds them to keep their client’s interest over their own, regardless of what stands to gain or lose. In addition, fiduciaries have the duty of care, loyalty, and to act in good faith.

WHY SHOULD YOU HIRE A FINANCIAL FIDUCIARY?

Still not sure about hiring a fiduciary advisor over a non-fiduciary? Let’s take a look at other reasons which will help clear up all of the “ifs, ands, and buts” (if any).

- YOU are your best fiduciary, but…

Indeed, you’ll have your best interest, but can you manage your money on your own? Do you have “the 3 T’s: Time, Technique and Temperament of investment”?

If you have the time and interest to educate yourself, technical knowledge to avoid mistakes, and temperament to execute the best decisions without a professional advisor, then you are doing good. But if you lack any of them, it is high time to get in touch with a Fiduciary Financial Advisors to assist you with your finances.

- Transparent fee’s structure

As per the fiduciary standards and their duties, fiduciary advisors must disclose all the fees they charge and commissions they receive ahead of investing their client’s money in any asset. The standards also discourage fiduciaries from parking client’s funds in investment products that charge high fees or have high expense ratios, as even these tiny fees, commissions and expenses can hurt your portfolio in the long run. Moreover, being clear about these charges helps develop a sense of security and a trusting relationship between the advisor and the client.

- Avoiding conflict of interest

Fiduciaries are also responsible to disclose any and all compensation they are entitled to while making any investment recommendations. Most of the savings made today are for a particular cause or for our retirement. These savings dollars must be invested in an organized manner and should minimize the possibility of any risk. Under the Department of Labor’s recently enacted fiduciary rule, fiduciary advisors dealing with retirement accounts cannot make a conflicting recommendation.

- High-quality research

Fiduciary money managers are experienced in their field and have a responsibility to perform high-end research before recommending any investment plan or product to their clients. They are not bound to one (or more) bank or an asset class. Hence, the research recommends a financial plan according to their clients’ future goals and risk-taking capacity. According to 2019 vanguard’s whitepaper, expert advice can increase returns by 3% per year. This extra return is also called “the advisor’s alpha.”

- Better asset allocation

Fiduciary Financial planners ask a lot of questions before selling you any investment product. They ask about your personal and future requirements and adhere to them. As the famous advice goes, “don’t put all eggs in one basket,” they recommend a vast array of financial products to diversify and optimize your investment portfolio. Fiduciaries are required to provide accurate and complete information with the sole aim of achieving your goals.

- Long term responsibility

Fiduciaries have the responsibility to monitor your investments and rebalance them from time in an attempt to maximize our investment returns. Updating and rebalancing investments by removing or replacing an old investment product with a new one, responding to changing financial situations.

BOTTOM LINE

A fiduciary advisor is determined to help you successfully achieve your financial goals by disclosing all the fees, avoiding conflict of interest, and adhere to your requirements by keeping your interest above them. If you are a new investor, ask the necessary questions to your advisor and invest with them only if they check all the boxes. On the other hand, if you already have an advisor and the practices mentioned above are not followed by them, you should consider finding a new one. We here at Prestige Financial Advisors are here to make sure we are doing what is best for you. This material is intended for educational purposes only and is not intended to serve as the basis for any purchasing decision.